The Insidious Game Of Anonymity In The Cryptocurrency Industry

Those in crypto know there is never a dull moment in this industry… After all, isn’t it one of the reasons why we love it?

And actually over the course of the last few weeks a bunch of events have really shaken up the space. We are referring to the latest happenings in Wonderland, BAYC and Balloonsville, all of which have one thing in common: the issue of anonymity.

But let’s go in order.

Anonymity vs. Pseudonymity

Talking about anonymity, there is a necessary disclaimer to be made, which regards the difference between anonymity and pseudonymity:

- Anonymity means that the identity of someone is unknown and its actions are not trackable;

- Other hand, pseudonymity means that someone’s identity is unknown, but it is possible to assign actions to the same person.

In the crypto space, most of the times when we hear about anonymity we are actually referring to pseudonymity. The majority of blockchains (starting with Bitcoin and Ethereum) are in fact pseudonymous, as the address is nothing more than a pseudonym for the person holding the corresponding private key. Since transactions are stored in distributed public ledgers (indeed, blockchains), whilst the final identity of a user might be unknown, transactions of any address are always trackable and referable to him/her.

Anonymity in crypto

Considering it in its most extended meaning, anonymity has been part of the DNA of crypto since its very beginning.

On the one hand, it is enough to consider that “crypto” stands for cryptography, the feature at the core of the blockchain technology and whose name is in turn derived from the Greek word “kryptos,” which means “hidden”. On the other hand, how not to mention that the person who started it all is known under the pseudonym of Satoshi Nakamoto.

Maybe it’s a matter of origins, maybe it’s because of the ambition to build a totally decentralized system in which “the code handles everything”, but in the crypto sector it’s not unusual to see projects founded by completely anonymous teams earning the trust of investors and raising billions in a very short time.

Why remain anonymous?

From uncertainty related to regulatory vacuums to strong ideals of decentralization, the reasons behind anonymity are wide ranging and may be either more or less legitimate.

On the one hand those who have illicit purposes may of course find anonymity convenient. If you think about it, it wasn’t that long ago when the media started talking about Bitcoin as the currency linked to financial crimes and money laundering.

But is it really correct to demonize something just because of bad actors managing to exploit it to their own advantage? Isn’t it true that illicit uses or scams occur in all contexts?

Looking at Bitcoin, we cannot avoid starting from the very purpose for which it was born: to have a free, trustless, censorship-resistant system allowing for the removal of the third party traditionally required to conduct digital monetary transfers. In this way, Bitcoin and crypto in general affect individual freedom and opportunities of anyone. It just doesn’t matter who you are or where you come from.

Would all of this have been possible if Satoshi Nakamoto’s true identity had been known? Or more likely would everything have been stopped?

Getting back to the three events we’ve mentioned at the beginning, let’s see what exactly happened.

Wonderland Ticket

Following the chronological order, the first has been the Wonderland case.

On January 28th, 2022 a Twitter user who goes by zachxbt revealed that 0xsifu – pseudonym of a core member of the founding team behind the Wonderland protocol – was actually Michael Patryn, previously involved with the $190 million QuadrigaCX fraud.

QuadrigaCX was a Canadian exchange (or should we say a Ponzi scheme?) that shut down after Patryn’s partner Gerald Cotten — apparently the only one in control of the platform’s private keys — suddenly died in India in 2018, at the age of 30 y.o..

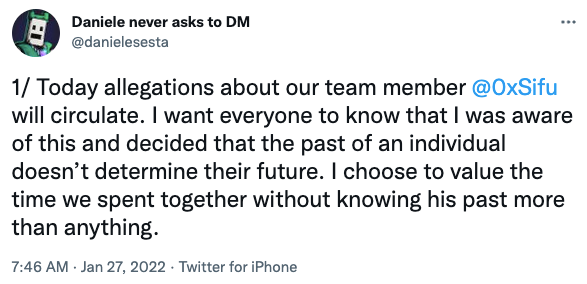

Following the release of this news, Daniele Sestagalli, founder of Wonderland, confirmed the content at hand and right before specifying he had only found out about Sifu’s identity recently, tweeted:

Thus claiming everyone’s right to a second chance (and of course his right to take this decision in place of the protocol’s community!).

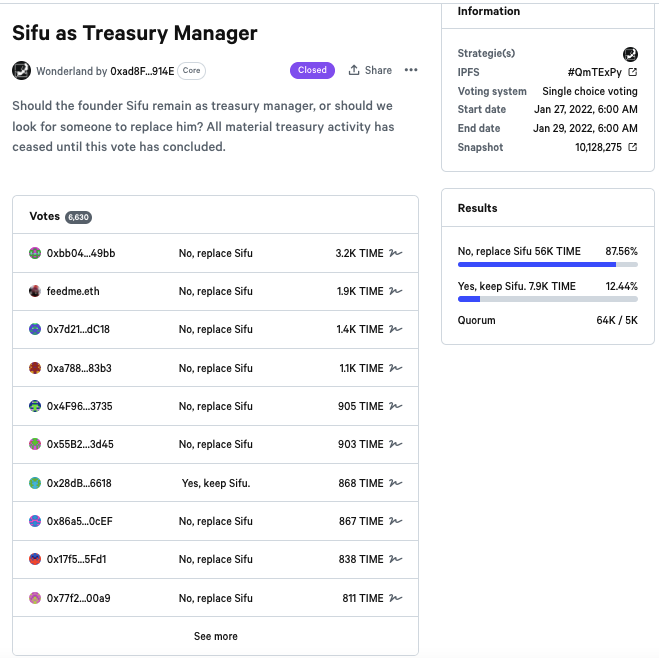

After all of this came up, the Wonderland DAO voted about whether to keep Sifu as treasury manager. The proposal closed with 87.56% of voters choosing to remove him from the treasury management.

Looks like this kind of information was far from being irrelevant to investors… Strange, isn’t it?

BAYC

With its 10,000 simian avatars, the Bored Ape Yacht Club (BAYC) has recently affirmed itself as the most expensive NFT collection in the world. Just think that at the time of writing the floor price to buy the cheapest one is 99.99 Eth (equal to about $294k), with a market cap of about $2.9 billion.

Based on the data from OpenSea, the collection now counts 6.3k owners. Among these also many celebrities, which helped to make owning these NFTs a real Status quo achievement, latest Paris Hilton and Jimmy Fallon, who recently showed off their printouts at The Tonight Show.

Yuga Labs is the company behind BAYC, while also in this case the team was fully anonymous. Yes, was! At least until on February 4th, 2022 BuzzFeed News decided to reveal the real names of the two founders, until then known under the names of “Gordon Goner” and “Gargamel”.

In its article, BuzzFeed News traces the history of the project and the profiles of the two founders, then feeds the public their identity, apparently for no reason other than their own satisfaction.

Since the past of the two founders seems to have nothing to hide (as BuzzFeed News itself points out), it is natural to wonder if violating their right to privacy in this way was truly necessary.

Balloonsville

Here comes the last one (for now). With its cartoonishly and colored NFT collection, Balloonsville was in the cards to become the next “blue chip” (the nickname used for projects that quickly increase tenfold in value).

With a team of developers that put their faces on it, a strong marketing campaign which captured the interest of thousands of collectors in a short time and an appealing roadmap ahead which also provided the NFT staking, it was no surprised that following its launch on Magic Eden Launchpad — one of the most popular NFT marketplaces on Solana — the collection sold out in a few hours.

What was more surprising was the rugpull which came right after! Especially since the minting of the collection happened on a platform like Magic Eden, which is supposed to be an additional guarantee of the reliability of a project.

A rugpull occurs when after the price of a project has been driven up, scammers sell and the price generally falls to zero. The team has in fact bailed on Balloonsville shortly after its mint. They made 5,000 SOL (today about $484k) and deleted the Twitter account, but only after issuing provocations including one stating:

“All it took was a couple of paid actors, and boom, we did it again”

In the meantime, Magic Eden started the race to remedy the damages created by the scammers and, apart from allocating funds to “derug” the Balloonsville project and refunding users who sold their Balloons below the mint price, the marketplace tweeted it would stop dealing with anonymous teams:

This is yet another scam shaking up Solana’s investment community, but also evidence that seeing two “real people” behind a project probably isn’t sufficient proof for trust.

Our view

What emerges is that, although all of these situations have to do with anonymity, they are extremely different from each other.

Bitcoin’s success is emblematic of how anonymity has been a key means to protect the protocol. If you don’t know who created it, you can’t stop it.

Instead, after the Wonderland affair it would be very easy to raise against the use of pseudonyms, but the case of BAYC clearly shows how anonymity itself does not represent a problem.

Finally, the last of these mentioned events is evidence that the risk of a scam can always occur. No matter what, there will always be people ready to put themselves in the spotlight to hide someone else’s bad intentions.

And while anonymity may be a tricky and complex issue to assess, what remains certain is that accountability is an essential value and without accountability there can be no trust. That’s why we at @Iconium are daily committed to optimizing our deal flow and carrying out rigorous due diligence processes in selecting the most promising projects in the space.

Can accountability coexist with anonymity? There is no doubt this question will come back in the next future and sooner or later a univocal answer will need to be found, but the future we’re building is ambitious and we are confident that this only constitutes another challenge, not a showstopper.

Iconium Team

Bitcoin, Blockchain, crypto, NFT